December 30, 2020

Realizable Pay Disclosures: Not Helping Your Say-on-Pay?

– Liz Dunshee

Before you dive in to crafting your next supplemental proxy disclosures about “realizable pay,” check out this recent study from ISS Corporate Solutions – suggesting that the extra disclosure doesn’t improve say-on-pay outcomes. As Mark Borges has blogged, these types of disclosures seem to be on the decline – and maybe they’re most useful when there’s a major transaction that would benefit from extra color. Here’s an excerpt from the ICS blog:

Based on our study, there appears to be no clear signal that realizable pay assessments in the proxy statements are materially impacting ISS SOP vote recommendations at S&P 500 companies, as companies that included realizable pay assessments in their proxy statement received positive vote recommendations from ISS on SOP at almost exactly the same rate as those companies that did not include a realizable pay assessment.

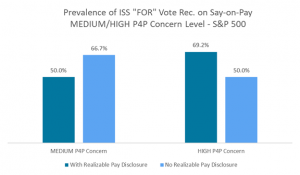

However, while the data above provide some initial insight into the impact of disclosing a realizable pay analysis on the ISS SOP vote recommendation, it’s important to recognize that ISS supports SOP proposals at different rates based on the initial pay-for-performance (P4P) concern levels identified in their quantitative frameworks.

For companies with elevated P4P concern levels, does the inclusion of a realizable pay assessment in the CD&A lead to a better chance of securing a positive vote recommendation from ISS on SOP?

Similar to the first outcome observed, these results suggest there is no definitive link between the inclusion of a realizable pay analysis in the proxy statement and subsequent support by ISS on the SOP proposal, i.e., companies with an elevated P4P concern level received “FOR” vote recommendations on their SOP proposal at the same rate whether they included a realizable pay assessment in their proxy statement or not.

Blog Preferences: Subscribe, unsubscribe, or change the frequency of email notifications for this blog.

UPDATE EMAIL PREFERENCESTry Out The Full Member Experience: Not a member of CompensationStandards.com? Start a free trial to explore the benefits of membership.

START MY FREE TRIAL